Importing Data and Computing Differences in fundsr

Stanislav Traykov

2026-02-16

Source:vignettes/importing-and-computing-differences.Rmd

importing-and-computing-differences.RmdThis vignette shows how to load data into fundsr and compute rolling differences (CAGR and log) using the example files shipped with the package. For a demonstration based on NAV histories downloaded from fund providers—which also covers liquidity plots and translation support—see Simple Demo Using Real Data. Guidance on obtaining real NAVs and index levels lives in the project wiki.

More complex workflows are provided (without data) under

scripts/examples in the package directory; start with

glob_funds.R or all_funds.R. The directory can

be located with

system.file("scripts/examples", package = "fundsr").

The master table

fundsr’s core workflow (Figure 1) consists of reading daily fund NAVs

and index levels from files and building a master series table.

Plottable tracking differences are computed from this table via

roll_diffs().

Figure 1: Rolling differences workflow

The master table has a date column named date and one

column per series (either fund NAVs or net/gross index levels; see Table

1 for an example). Fund NAV columns use lowercase names by convention

(e.g. spyy). Index level columns are typically uppercase

(e.g. ACWI, GMLM, SP500) or

mixed-case with an initial uppercase letter (e.g. WxUSA).

Net total return levels are stored under a shortened index name, while

gross total return levels are identified by a -GR suffix

(e.g. ACWI-GR, SP500-GR).

Note: The lowercase naming is useful because fund

identifiers (typically tickers) may coincide with index names

(e.g. Amundi’s ACWI). The -GR suffix is the default value

of the gross_suffix parameter in roll_diffs(),

which is used to switch between net and gross calculations.

IMPORTANT: Only NAV histories of accumulating funds are valid inputs, as these are equivalent to total return series. fundsr does not support total return calculation for distributing ETFs and using it with such NAVs will produce garbage. (I am not aware of a free source of comprehensive distribution histories for UCITS ETFs that would allow reconstruction of total return.)

| date | iusq | spyi | spyy | webn | scwx | ACWI | ACWI-GR | GMLM | GMLM-GR |

|---|---|---|---|---|---|---|---|---|---|

| 2025-10-14 | 104.5 | 279.6 | 277.5 | 12.57 | 11.67 | 536.7 | 2307 | 2467 | 2569 |

| 2025-10-15 | 105.2 | 281.7 | 279.5 | 12.67 | 11.75 | 540.6 | 2324 | 2485 | 2588 |

| 2025-10-16 | 105.1 | 281.4 | 279.3 | 12.66 | 11.74 | 540.0 | 2321 | 2483 | 2586 |

| 2025-10-17 | 105.1 | 281.1 | 279.2 | 12.65 | 11.73 | 539.8 | 2320 | 2481 | 2584 |

| 2025-10-20 | 106.3 | 284.5 | 282.5 | 12.80 | 11.87 | 546.3 | 2348 | 2511 | 2615 |

| 2025-10-21 | 106.2 | 284.3 | 282.3 | 12.79 | 11.86 | 545.8 | 2346 | 2508 | 2613 |

| 2025-10-22 | 105.8 | 283.1 | 281.2 | 12.74 | 11.82 | 543.6 | 2337 | 2499 | 2603 |

Setup

fundsr_options() can be used to set (and sanity-check)

package options.

fundsr reads fund NAVs and index levels from a single directory

specified via the fundsr.data_dir option. The following

code sets it to the extdata directory shipped with the

package. The plot output directory is set to output (option

fundsr.out_dir).

fundsr_options(

data_dir = system.file("extdata", package = "fundsr"),

out_dir = "output", # where to store plots

export_svg = TRUE, # output SVG (main workflow)

px_width = 1300, # for optional PNG output

# internal_png = TRUE, # output PNG using ggplot2

# Need to set path only if auto-detection fails

# inkscape = "path/to" # optional PNG output via Inkscape

)Note: In normal use, fundsr may also write to the

data directory, if download_fund_data() is used.

Importing

Importing usually involves reading fund NAVs and index levels from

Excel, CSV, or TSV files into data frames and storing them in fundsr’s

cached storage environment, from which the master table is constructed

(typically via a single call to build_all_series()). A

fund→index map, required for tracking-difference calculations, is

maintained and updated as new series are added.

The example files in Table 2 (shipped with the package in

extdata) are used to demonstrate the importing

functions.

| File | Type | Description |

|---|---|---|

| FNDA.xlsx | Excel | NAVs for fund FNDA tracking IDX1 |

| FNDB.xlsx | Excel | FNDB tracking IDX1, fund launched 2024-03-16 |

| GNDA.xlsx | Excel | NAVs for fund GNDA tracking IDX2 |

| GNDB.csv | CSV | NAVs for fund GNDB tracking IDX2 |

| IDX1.xlsx | Excel | index levels for IDX1, net and gross |

| IDX2G.csv | CSV | index levels for IDX2, gross return |

| IDX2N.csv | CSV | index levels for IDX2, net return |

store_timeseries()

store_timeseries() is the basic function for importing

into the storage environment. It is most commonly used via wrappers such

as load_fund() or the vendor-specific wrappers around

load_fund()—handling Excel NAV histories from Amundi, HSBC,

Invesco, iShares, SPDR, UBS, Vanguard, and Xtrackers. It is often called

directly when importing CSV/TSV files or data frames.

The example fund GNDB has a NAV history in CSV format with dates expressed as milliseconds since the Unix epoch, a NAV column, and a Benchmark column that will not be imported from the fund file in this example.

Date,NAV,Benchmark

1704067200000,100,100

1704153600000,101.595595,101.588368

1704240000000,100.510764,100.494977GNDB’s NAV data can be loaded into fundsr’s storage environment by

reading it as a tibble via read_timeseries().

read_timeseries() recognizes the date format, parses the

dates, and renames the date column to date, as required for

the master table. The NAV column from the CSV file has to

be renamed separately to a lowercase fund identifier for the master

table. The select() in the middle of the pipeline ensures

the extraneous Benchmark column is not included (we will

import the benchmark later from its own file).

store_timeseries(

var_name = "gndb",

expr = read_timeseries("GNDB.csv", date_col = "Date") |>

select(date, NAV) |>

rename(gndb = NAV),

fund_index_map = c(gndb = "IDX2")

)The variable name used for the storage environment

(var_name) can be chosen arbitrarily and serves as the

cache key. The fund_index_map parameter defines a mapping

from fund identifier to its corresponding index identifier.

Note: To make use of caching, the expression

supplied via the expr parameter should not

contain a ready-made tibble or similar, constructed outside of the call.

It should contain a function call or pipeline that performs the

potentially costly operations, like loading from Excel, the Internet,

etc. If var_name is already present in fundsr’s storage

environment, the expression will not be evaluated at

the time of the store_timeseries() call, unless a reload is

being requested or the overwrite parameter to

store_timeseries() is TRUE. (See Using data loaders and Resetting and reloading.)

When loading gross indices, the convention is to map them to the net

index in the fund_index_map

(e.g. SP500-GR→SP500). This allows gross

indices to be plotted against net indices. When plotted against the net

index, the gross index serves a reference equivalent to an ETF with

perfect tracking, no withholding taxes, and no ongoing fees.

The following code block uses store_timeseries() to load

the IDX1 and IDX2 indices, tracked by the

example funds. read_timeseries_excel() flexibly reads Excel

files and accepts a col_trans argument to translate Excel

columns (matched using regular expressions) to imported columns.

IDX2 is imported into a single variable (idx2)

by joining the net and gross time series (via

dplyr::full_join()). The columns in

IDX2{N,G}.csv are already appropriately named for the

master table. Importing the files into separate variables via two calls

to store_timeseries() would lead to the same master

table.

store_timeseries(

var_name = "idx1",

expr = read_timeseries_excel(

file = "IDX1.xlsx",

sheet = 1,

date_col = "^Date",

col_trans = c("IDX1" = "^Index One Net",

"IDX1-GR" = "^Index One Gross"),

date_order = "dmy"

),

fund_index_map = c(`IDX1-GR` = "IDX1")

)

#> Reading Excel: '/tmp/Rtmp9scYrL/temp_libpath1b937280693/fundsr/extdata/IDX1.xlsx'

store_timeseries(

var_name = "idx2",

expr = full_join(read_timeseries("IDX2N.csv"),

read_timeseries("IDX2G.csv"),

by = "date"),

fund_index_map = c(`IDX2-GR` = "IDX2")

)

load_fund()

load_fund() reads an Excel file with fund NAVs into the

storage environment (it calls store_timeseries() with an

expression that uses read_timeseries_excel()). It accepts

regular expressions for identifying the date and NAV

columns and a sheet (name or number) selecting the

worksheet within the Excel workbook that contains the NAV history. The

default values are date_col = "^Date",

nav_col = "^NAV", and sheet = 1 (which works

for single-sheet workbooks). The first argument (usually a fund ticker),

converted to lowercase, is used as the variable name for

store_timeseries() and as the tibble column name that will

eventually propagate to the master table. The benchmark

argument provides the fund→index mapping.

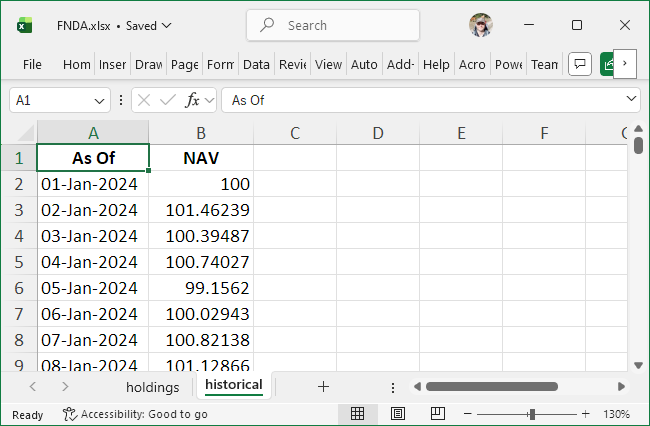

Figure 2: Excel file for FNDA

The NAV history for FNDA is provided in an Excel workbook with

multiple sheets and a date column named “As Of” (Figure 2). If the

defaults for sheet, date_col, or

nav_col do not match the file layout, you

must specify the relevant parameters. They will be used

to reliably locate the NAV and date ranges even when the sheet contains

extraneous rows and columns around the data (common in fund-manager

files). For this file, sheet and date_col are

required; nav_col is optional because the default would

still match.

load_fund("FNDA",

"FNDA.xlsx",

benchmark = "IDX1",

sheet = "historical",

date_col = "^As Of",

nav_col = "^NAV")

#> Reading Excel: '/tmp/Rtmp9scYrL/temp_libpath1b937280693/fundsr/extdata/FNDA.xlsx'load_fund() recognizes proper Excel dates, improperly

stored Excel dates, and a large number of text date formats used in fund

files, but the date order (e.g. "dmy", "mdy",

"ymd") must be known for interpretation of text dates. It

defaults to "dmy" which is the most common in UCITS ETF NAV

histories.

FNDB has text dates in MM/DD/YYYY format, so supplying

date_order = "mdy" is required.

load_fund("FNDB",

"FNDB.xlsx",

benchmark = "IDX1",

date_col = "^date",

nav_col = "^net asset val",

date_order = "mdy")

#> Reading Excel: '/tmp/Rtmp9scYrL/temp_libpath1b937280693/fundsr/extdata/FNDB.xlsx'The final fund to load is GNDA.

load_fund("GNDA",

"GNDA.xlsx",

benchmark = "IDX2",

date_col = "^Date",

nav_col = "^Official NAV")

#> Reading Excel: '/tmp/Rtmp9scYrL/temp_libpath1b937280693/fundsr/extdata/GNDA.xlsx'Building the master table

First, verify that all funds and indices from the previous sections have been loaded into the storage environment, and that columns follow the naming convention: lowercase for funds and uppercase (or initial uppercase) for indices.

s <- get_storage()

ls(s)

#> [1] "fnda" "fndb" "gnda" "gndb" "idx1" "idx2"

for (v in ls(s)) {

print(as.data.frame(slice_head(s[[v]], n = 2)))

}

#> date fnda

#> 1 2024-01-01 100.0000

#> 2 2024-01-02 101.4624

#> date fndb

#> 1 2024-03-16 106.2136

#> 2 2024-03-17 104.2975

#> date gnda

#> 1 2024-01-01 100.0000

#> 2 2024-01-02 101.5749

#> date gndb

#> 1 2024-01-01 100.0000

#> 2 2024-01-02 101.5956

#> date IDX1 IDX1-GR

#> 1 2024-01-01 100.0000 100.0000

#> 2 2024-01-02 101.4753 101.4767

#> date IDX2 IDX2-GR

#> 1 2024-01-01 100.0000 100.00

#> 2 2024-01-02 101.5884 101.59build_all_series() joins all tibbles (or other types of

data frames) in the storage environment into a single tibble—the master

series table.

master_series <- build_all_series()master_series should now be a tibble resembling Table 3.

The fndb column contains NA values in the

initial rows due to FNDB launching in 2024-03-16 (the first NAV date in

its Excel file).

| date | fnda | fndb | gnda | gndb | IDX1 | IDX1-GR | IDX2 | IDX2-GR |

|---|---|---|---|---|---|---|---|---|

| 2024-01-01 | 100.000 | NA | 100.000 | 100.000 | 100.000 | 100.000 | 100.000 | 100.000 |

| 2024-01-02 | 101.462 | NA | 101.575 | 101.596 | 101.475 | 101.477 | 101.588 | 101.590 |

| 2024-01-03 | 100.395 | NA | 100.487 | 100.511 | 100.390 | 100.392 | 100.495 | 100.498 |

| 2024-01-04 | 100.740 | NA | 100.622 | 100.619 | 100.736 | 100.740 | 100.613 | 100.618 |

| 2024-01-05 | 99.156 | NA | 99.112 | 99.089 | 99.166 | 99.172 | 99.104 | 99.111 |

| 2024-01-06 | 100.029 | NA | 100.140 | 100.126 | 100.051 | 100.058 | 100.156 | 100.164 |

Advanced joining

If there are multiple sources for the same series and values need to

be coalesced into a single column, both series can be loaded with the

same column name into different variables in the storage environment.

When building the series, one can be designated late.

# load fund NAVs, uses default "acme" for column and storage variable

load_fund("ACME",

file = "ACME1.xlsx",

date_col = "As Of")

# also load NAVs into "acme" column, but storage variable is "acme2"

load_fund("ACME",

var_name = "acme2",

file = "ACME2.xlsx",

date_col = "As Of")

# join "acme" and "acme2"

# both columns will be available, named "acme.late" and "acme.early"

series <- build_all_series(late = "acme2")

# join and coalesce

# on dates where both columns have values, prefer "acme2"

series <- build_all_series(late = "acme2",

join_precedence = c(".late", ".early"))

# as above, but instead of the default left join, perform a full join

series <- build_all_series(late = "acme2",

join_precedence = c(".late", ".early"),

late_join = dplyr::full_join)Vendor-specific wrappers

The following wrappers use load_fund() to import Excel

files provided by fund managers.

-

amun()(Amundi) -

hsbc()(HSBC) -

inve()(Invesco) -

ishs()(iShares) -

spdr()(SPDR) -

ubs()(UBS) -

vang()(Vanguard) -

xtra()(Xtrackers)

Example usage:

xtra("EXUS", benchmark = "WxUSA",

file = "HistoricalData-IE0006WW1TQ4.xlsx")

xtra("EXUS", benchmark = "WxUSA") # assumes EXUS.xls[x]Note: MSCI Excel downloads can be imported via

msci(). MSCI TSV files (the download format for leveraged

indices) can be read via read_msci_tsv().

Downloading NAV histories

fundsr can download Excel files from iShares and SPDR. Funds and URLs

can be set up via add_fund_urls().

add_fund_urls(c(

SPYY = "https://www.ssga.com/ie/en_gb/institutional/library-content/products/fund-data/etfs/emea/navhist-emea-en-spyy-gy.xlsx",

IUSQ = "https://www.ishares.com/uk/individual/en/products/251850/ishares-msci-acwi-ucits-etf/1535604580409.ajax?fileType=xls&fileName=iShares-MSCI-ACWI-UCITS-ETF-USD-Acc_fund&dataType=fund"

))Downloaded files are stored in the data directory

(fundsr.data_dir option) as SPYY.xlsx, etc.

This allows for easy importing via the vendor-specific wrappers.

# do not redownload existing files (the default)

download_fund_data(redownload = FALSE)

spdr("SPYY", benchmark = "ACWI") # assumes SPYY.xls[x]

ishs("IUSQ", benchmark = "ACWI")

series <- build_all_series()Retrieving benchmarks from fund files

Some fund managers include a benchmark return series in their Excel

downloads. fundsr can retrieve this benchmark via the

retrieve_benchmark parameter (supported for Invesco,

iShares, and Xtrackers).

ishs("IUSQ", benchmark = "ACWI", retrieve_benchmark = TRUE)Note: Benchmark series from fund files may have missing values. If available, data files from the index provider should be preferred.

Using data loaders

Before joining the data frames in the storage environment,

build_all_series() calls run_data_loaders()

which invokes all registered as data loaders. Instead of directly

calling store_timeseries(), load_fund(), etc.,

more complex workflows should register functions as data loaders via

add_data_loader(). A script setting up funds tracking MSCI

ACWI could do the following.

add_fund_urls(c(

IUSQ = "https://...",

SPYY = "https://...",

))

download_fund_data() # download only missing files

add_data_loader(function() {

# downloaded via download_fund_data()

spdr("SPYY", benchmark = "ACWI")

ishs("IUSQ", benchmark = "ACWI",

retrieve_benchmark = TRUE)

# manual download

xtra("SCWX", benchmark = "ACWI",

file = "HistoricalData-LU2903252349.xlsx")

})Note: Data loaders calling

store_timeseries() directly should make use of the caching

mechanic and provide costly operations (file reads, downloads) as the

second (or expr) parameter to

store_timeseries(). This parameter will not be evaluated

when the data loader is run, unless the variable is missing from the

storage environment or a reload is requested.

An example data loader handling more funds and index data is shown in the following code block.

add_data_loader(function() {

### Indices

# Solactive GBS GM L&M Cap

store_timeseries("gmlm", read_timeseries("GMLM.csv"))

store_timeseries("gmlm-gr", read_timeseries("GMLM-GR.csv"),

fund_index_map = c(`GMLM-GR` = "GMLM"))

# FTSE All-World

store_timeseries("ftaw", read_timeseries("FTAW.csv"),

fund_index_map = c(`FTAW-GR` = "FTAW"))

# MSCI ACWI and ACWI IMI

msci(var_name = "msci-nt",

col_trans = c(ACWI = "^ACWI Standard",

ACWI_IMI = "^ACWI IMI"),

file = "MSCI-NT.xls")

msci(var_name = "msci-gr",

col_trans = c(`ACWI-GR` = "^ACWI Standard",

`ACWI_IMI-GR` = "^ACWI IMI"),

benchmarks = c(`ACWI-GR` = "ACWI",

`ACWI_IMI-GR` = "ACWI_IMI"),

file = "MSCI-GR.xls")

### Funds

# manual downloads

amun("WEBN", benchmark = "GMLM",

file = "NAV History_Amundi_WEBN.xlsx")

vang("VWCE", benchmark = "FTAW",

file = "Vanguard FTSE All-World UCITS.xlsx")

xtra("SCWX", benchmark = "ACWI",

file = "HistoricalData-LU2903252349.xlsx")

inve("FWRA", benchmark = "FTAW") # "FWRA.xls[x]" assumed

# downloaded via download_fund_data()

spdr("SPYY", benchmark = "ACWI")

spdr("SPYI", benchmark = "ACWI_IMI")

ishs("IUSQ", benchmark = "ACWI")

})Call all registered data loaders and build the master series table by joining all objects in the storage environment.

series <- build_all_series()Only call registered loaders, without joining the objects. Returns

the storage environment (also available directly via

get_storage()).

storage <- run_data_loaders()Build the master table without running data loaders.

series <- join_env(storage, by = "date")Resetting and reloading

A full reload (rerunning the registered data loaders and rebuilding

the master table) can be accomplished via

run_data_loaders() and join_env() or a single

call to build_all_series() with the reload

parameter set to TRUE.

# rerun data loaders, discard variables in storage environment

storage <- run_data_loaders(reload = TRUE)

# reconstruct series table

series <- join_env(storage, by = "date")

# equivalent, piped

series <- run_data_loaders(reload = TRUE) |>

join_env(by = "date")

# equivalent, via build_all_series() helper

series <- build_all_series(reload = TRUE)Downloaded files can be refreshed with the redownload

parameter.

download_fund_data(redownload = TRUE)The package state can be fully reset with

reset_state().

# reset everything (except fundsr.* options)

reset_state()More granular resetting functions are also available.

# reset the storage environment (optionally also the fund-index map)

clear_storage()

clear_storage(clear_map = TRUE)

# just the fund-index map

clear_fund_index_map()

# deregister all data loaders

clear_data_loaders()Calculating differences

roll_diffs() calculates CAGR differences and log-return

differences from a master series table. It returns a named list with

elements cagr and log (each a data frame).

Using the constructed master_series table from Building the master table, the

rolling net and gross differences can be calculated with the following

calls.

n_days <- 365 # 365-day rolling window

diffs_net <- roll_diffs(master_series,

n_days,

get_fund_index_map(),

index_level = "net")

#> Roll diffs gndb -> IDX2

#> Roll diffs IDX1-GR -> IDX1

#> Roll diffs IDX2-GR -> IDX2

#> Roll diffs fnda -> IDX1

#> Roll diffs fndb -> IDX1

#> Roll diffs gnda -> IDX2

diffs_gross <- roll_diffs(master_series,

n_days,

get_fund_index_map(),

index_level = "gross")

#> Roll diffs gndb -> IDX2-GR

#> Skipping IDX1-GR: self-tracking

#> Skipping IDX2-GR: self-tracking

#> Roll diffs fnda -> IDX1-GR

#> Roll diffs fndb -> IDX1-GR

#> Roll diffs gnda -> IDX2-GRThe following code performs the same calculation, avoiding repetition

and silencing roll_diffs() via the messages

parameter. Differences can be accessed via diffs$net$cagr,

diffs$gross$log, etc.

diffs <- purrr::map(

list(net = "net", gross = "gross"),

~ roll_diffs(master_series,

n_days,

get_fund_index_map(),

index_level = .x,

messages = NULL)

)Inspect the most recent 365-day differences in basis points (bps).

# show last 3 rows, multiplied by 10K (=> bps),

# and rounded to 4 significant digits

checkout <- function(x) {

x |>

slice_tail(n = 3) |>

mutate(across(-date, ~ signif(.x * 10000, digits = 4)))

}

checkout(diffs_gross$cagr)

#> date gndb IDX1-GR IDX2-GR fnda fndb gnda

#> 1 2025-12-28 -118.3 NA NA -22.56 -5.122 -1.621

#> 2 2025-12-29 -118.5 NA NA -25.65 -5.872 -3.119

#> 3 2025-12-30 -113.3 NA NA -28.56 -1.171 -4.020

checkout(diffs_net$log)

#> date gndb IDX1-GR IDX2-GR fnda fndb gnda

#> 1 2025-12-28 -59.21 49.16 48.4 28.84 44.55 46.93

#> 2 2025-12-29 -59.28 49.16 48.4 26.04 43.87 45.58

#> 3 2025-12-30 -56.58 49.16 48.4 23.08 48.09 44.70

checkout(diffs$net$log) # same

#> date gndb IDX1-GR IDX2-GR fnda fndb gnda

#> 1 2025-12-28 -59.21 49.16 48.4 28.84 44.55 46.93

#> 2 2025-12-29 -59.28 49.16 48.4 26.04 43.87 45.58

#> 3 2025-12-30 -56.58 49.16 48.4 23.08 48.09 44.70Plotting

Setup

funds <- c("fnda", "fndb", "gnda", "gndb", "IDX1-GR", "IDX2-GR")

gg <- scale_color_manual(

labels = toupper, # uppercase fund names for the legend

values = c(

"IDX1-GR" = "black",

"IDX2-GR" = "grey60",

"fnda" = "#1bbe27",

"fndb" = "#e97f02",

"gnda" = "#b530b3",

"gndb" = "#37598a"

)

)Output

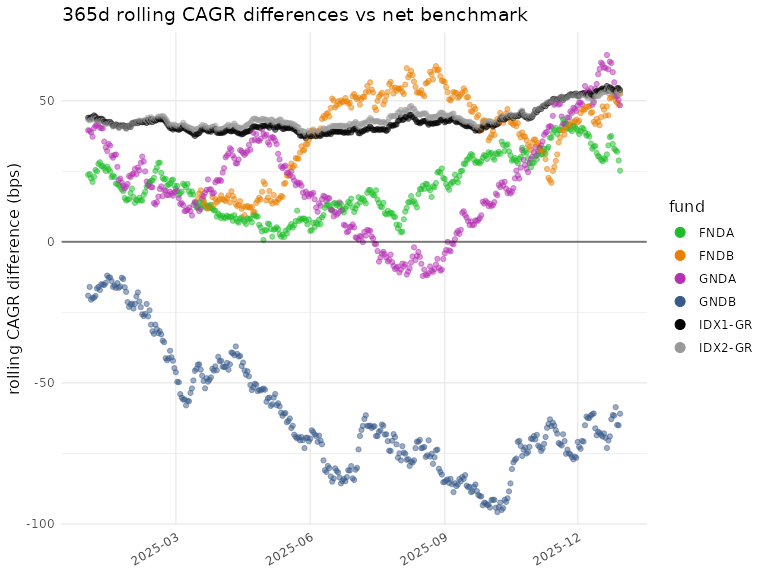

plot_roll_diffs(diffs_net$cagr,

funds = funds,

n_days = n_days,

use_log = FALSE,

bmark_type = "net",

gg_params = gg)

#> plot_roll_diffs: 365d rolling CAGR differences vs net benchmark

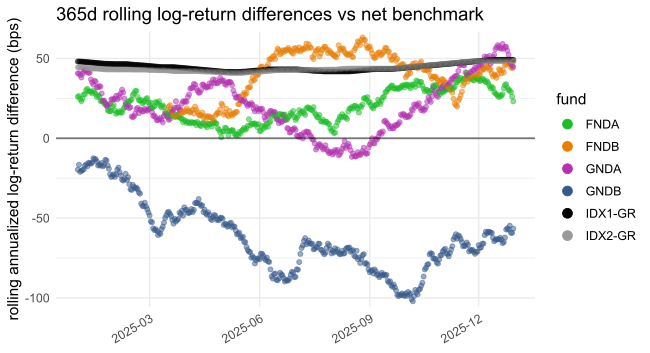

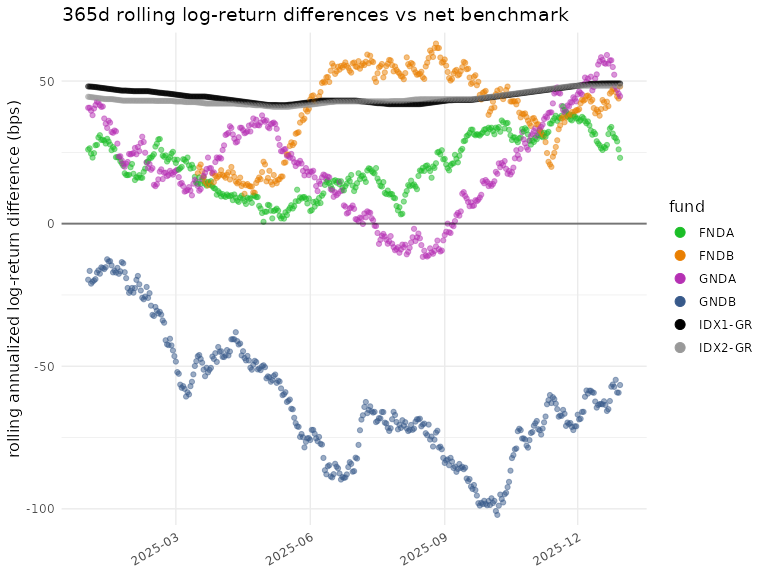

plot_roll_diffs(diffs_net$log,

funds = funds,

n_days = n_days,

use_log = TRUE,

bmark_type = "net",

gg_params = gg)

#> plot_roll_diffs: 365d rolling log-return differences vs net benchmark

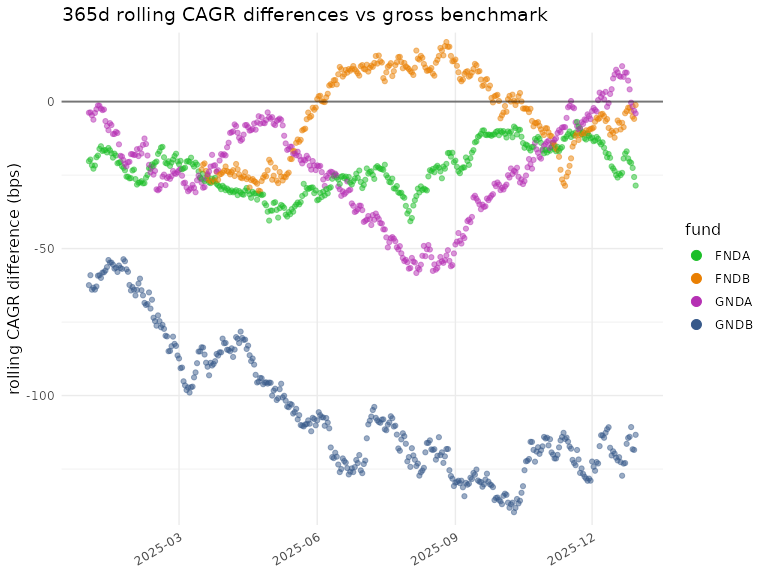

plot_roll_diffs(diffs_gross$cagr,

funds = funds,

n_days = n_days,

use_log = FALSE,

bmark_type = "gross",

gg_params = gg)

#> plot_roll_diffs: 365d rolling CAGR differences vs gross benchmark

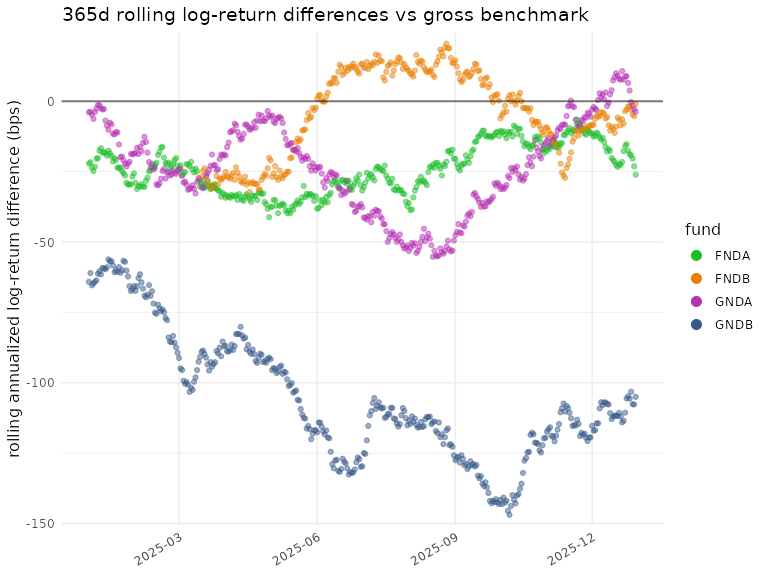

plot_roll_diffs(diffs_gross$log,

funds = funds,

n_days = n_days,

use_log = TRUE,

bmark_type = "gross",

gg_params = gg)

#> plot_roll_diffs: 365d rolling log-return differences vs gross benchmark

See run_plots() and the examples under

scripts/examples for a way to generate plots via flexible

specifications.